Just in: Subsplash is announcing a new webinar to learn more on this popular topic. If you enjoy this post, check out the webinar coming up April 25, 2017. Register here.

Does your church or ministry have online and mobile giving? Yes? Awesome! Did you know that it’s likely you are being overcharged? Not awesome. Hopefully this is not the case for you, but the unfortunate reality is that many churches are paying extremely high percentages on every giving transaction and they don’t even know it. Want to make sure your church isn’t one of them? We’ve got you! Most churches have decent processing rates, but high effective rates - and that’s where the problem lies. Let’s take a look at how to find out what your effective rate is and what you can do about it.

Wait….what’s an “effective rate”? And how do I find mine?

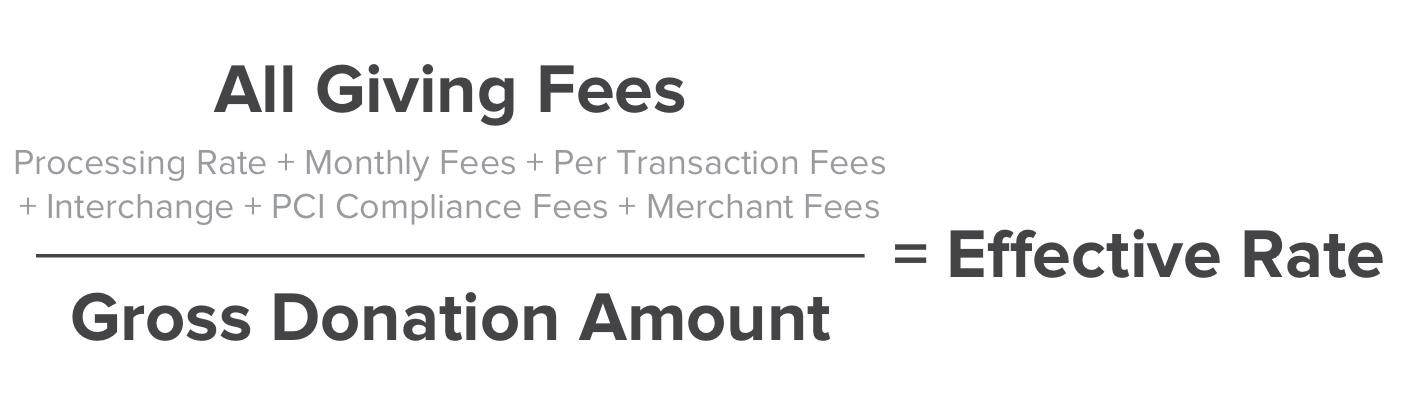

Any giving provider you talk to should (hopefully) be transparent about their processing rates, but they may not go into much detail about their effective rates. These two things are NOT the same. In many cases, the effective rate may be higher than the processing rate. So what exactly does “effective rate” mean? Glad you asked! Your effective rate is going to be the total percentage of money that the giving provider (and any third-party service involved with the transaction) is taking from every donation. This includes processing fees, per transaction fees, monthly fees, interchange fees, PCI compliance fees, merchant account fees, and more. If you want to know what your effective rate is, you can easily find out by taking a look at your monthly giving statements. Add up all of the fees your giving provider charged on that statement (this includes everything we mentioned above) and divide that number by the gross donation amount on that statement. Boom. There’s your effective rate.

How do my rates stack up?

Let’s say you just did the math and it turns out your church’s effective rate is around 4%. That’s not good. You can get better. Despite offering decent processing rates, many companies charge extra hidden fees for some of those things we mentioned above, such as interchange, PCI compliance, merchant accounts, and more, which causes the total effective rate to be much higher than the processing rate. Even worse, most churches in this scenario may not realize that they are paying these extra fees. Does that sound like a huge bummer? Well, it is. That’s why finding your effective rate is so important - it allows you to see a common ground comparison between all giving providers. Simply put, if your church’s effective rate is 4% or higher, you are overpaying. If it is 3% or higher, you could be doing better. And if it’s in the 2s, you are in great shape!

What you can do

Hopefully your church is in the 2% range, but if not, don’t lose hope! There are a few things you can do to ensure your ministry gets to keep as much of your donations as possible. First, if you are shopping around for giving providers, make sure to get clarity about each company’s effective rate (remember, it’s not the same as the processing rate). You can simply ask, “If John donates $100 to our ministry with his debit card, how much of that $100 will end up in our bank account after all fees are taken out?” If you find that your church is currently paying too much, call your giving provider and inquire about getting a lower rate. You can use our cheat sheet above for reference. And finally, if you’d like to skip dealing with high effective rates altogether, we’d love to help your ministry keep more of your donations. We’re not really into this whole “hidden fees” thing. To get more resources about lowering your effective rate, drop us a line at hello@subsplash.com!